■ Portfolio Analysis

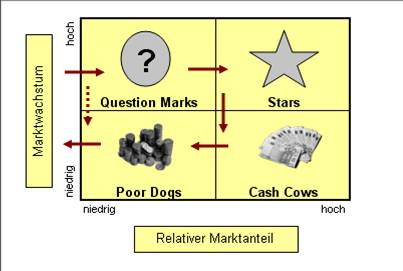

Based on our analysis, we support the portfolio-level decision makers in the transparent consideration of opportunities and risks of an enterprise and the economic composition and development of real estate portfolios. The challenge of a real estate portfolio analysis is the characterization of properties of a real estate portfolio with the help of an economic model, which is part of real estate management in planning, decision-making, realization and control application. We make use of the four-field matrix, which is based on a comprehensive data pool (questionnaire).

Our portfolio analysis is divided into two levels:

1. The Property Level starts with ...

Market-Research: size of the market - market indicators as – transaction- and leasing-numbers - new building-volume - etc.

and continues with the valuation of the...

Micro-Location: infrastructure - prevailing usage - daily goods - etc.

Property Assessment: infrastructure of the building – lettability – divisibility - floor sizes, special features - fit out – architecture - etc.

Technical infrastructure: cabling - air conditioning – heating – elevators - etc.

and leads finally to

=► allocation of the single property on the matrix and procedure recommendation.

2. The Portfolio Level discloses ...

• geographical distribution

• lease extensions

• usage of the property

• size classes of properties according to gross rental value

• age structure

...and leads finally to

=► procedure recommendation